If you’re setting up an online store with WordPress, then choosing between Stripe and PayPal can be a struggle. With all those confusing transaction fee tables and long lists of payment methods – how are you supposed to make sense of it all?

Plus, it can feel like a massive decision when you hear scary stories about customers abandoning their carts just because the checkout process isn’t right. Every lost sale hurts when you’re building a business.

But we’re here with some good news – you don’t have to stress about this decision!

We use both Stripe and PayPal in our own stores, serving plenty of happy customers. This experience has taught us exactly what each payment processor does best.

Just think of us as your payment processing guides!

We’ve done all the research for you – comparing fees, testing features, and learning why customers prefer one platform over the other.

And in this guide, we’ll help you pick the perfect payment solution for your WordPress store.

Overview of Stripe vs. PayPal: Which Is Better for Your Site?

If you are in a hurry, then just take a quick look at our comparison table for Stripe vs. PayPal:

An Introduction to Stripe vs. PayPal

Stripe is a super flexible payment processor currently running on over 1.5 million websites.

It is perfect if you want to offer a bunch of different payment methods to your customers. Stripe accepts credit cards, digital wallets, and recurring payments, making it a great option for subscription services or eCommerce stores.

That’s why we use it to accept payments on several of our eCommerce sites built with WordPress.

We really love how the platform makes it easy to go global. However, its high number of customization options might feel a little overwhelming if you are just starting out.

PayPal, on the other hand, is a household name that customers often feel comfortable using. In fact, it leads the payment processing market share (25.8%), followed closely by Stripe (23.4%).

We also offer PayPal as a payment option on our eCommerce websites for this reason.

The payment processor makes it easy to accept payments from credit cards and PayPal accounts.

In our opinion, PayPal’s biggest strength lies in its simplicity and ease of use. It’s a great choice for anyone who wants to get started selling online without dealing with too many settings.

Still, some businesses might find their transaction fees a bit high compared to other options.

Overall, Stripe and PayPal both have a lot to offer, and both work well with WordPress, so the best choice will depend on your needs.

To help you decide, we have compared Stripe vs. PayPal in depth to see which one comes out on top. During our research and evaluation, we considered the following criteria:

You can use the links above to skip to any section.

📣 Why Trust WPBeginner?

At WPBeginner, we’re a team of experts with experience in WordPress, eCommerce, SEO, online marketing, web hosting, and more.

In terms of payment processors, we have used both Stripe and PayPal to securely accept payments from customers around the world.

Over time, we have thoroughly tested both platforms for ease of use, their ability to handle global transactions, the variety of payment options they support, and their transaction fees.

By using these processors ourselves, we’ve been able to see firsthand how they simplify the checkout process. To learn more, just see our editorial process.

Are you ready? Let’s go!

Ease of Use

An easy-to-use payment processor can help your business run smoothly, and an intuitive platform allows you to set up and manage payments without technical knowledge. That way, you can focus on growing your business.

With that in mind, here’s how Stripe and PayPal compare in terms of ease of use.

Ease of Use – PayPal

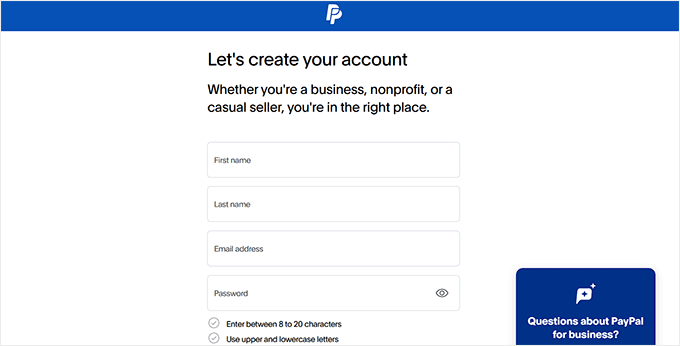

PayPal is one of the easiest payment processors to set up and use, which is why it is so popular among beginners and small business owners.

You can create an account, link your bank or credit card, and start accepting online payments right away.

Plus, since most people are already familiar with PayPal, your customers won’t need much convincing to use it, which can help boost sales.

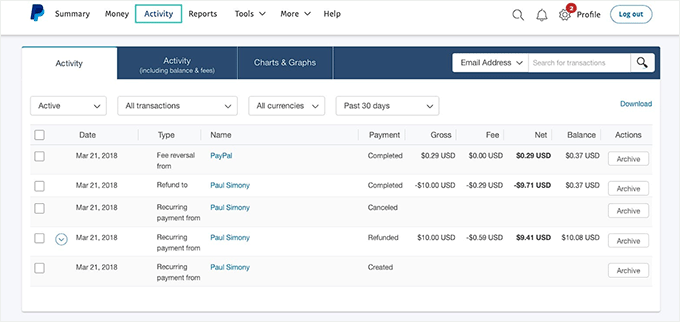

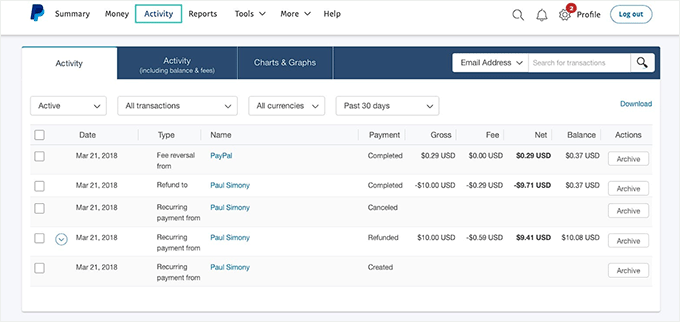

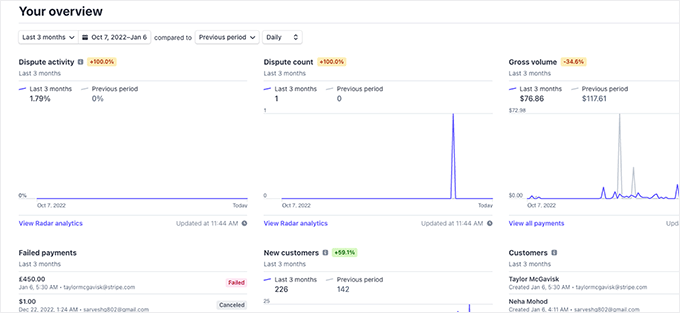

During our testing, we also found PayPal’s dashboard to be super user-friendly. It’s clean, simple, and easy to navigate, even if you’re not tech-savvy.

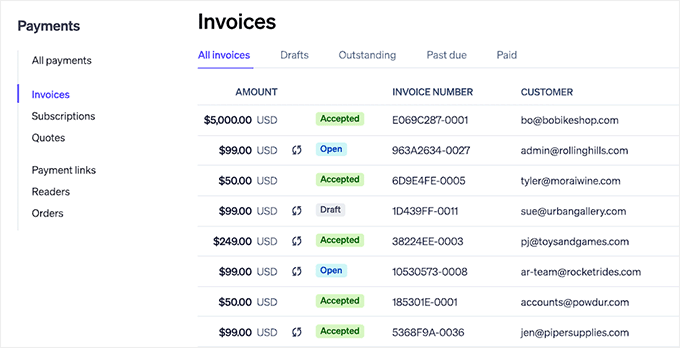

From the dashboard, you can manage all your payments in one place, view transactions, send invoices, issue refunds, and even handle disputes.

Additionally, you can see helpful insights, like a breakdown of your recent sales and payment activity. This makes it easy to keep track of your business performance without needing extra tools.

Overall, PayPal is a great choice for beginners because using it to accept payments doesn’t require any technical skills.

Ease of Use – Stripe

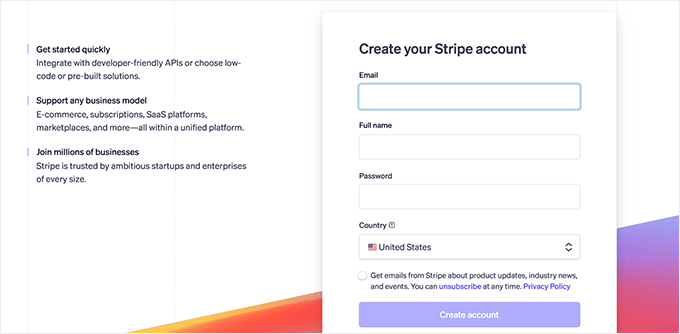

Even though Stripe is known for its advanced features and customizations, in our experience, it is surprisingly easy to use.

All you have to do is create an account and add your business and banking details. Then, you’re ready to start accepting payments.

Plus, Stripe’s documentation offers plenty of tutorials and guides to help you get started.

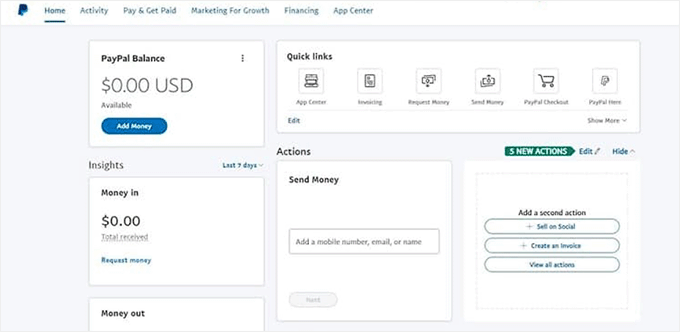

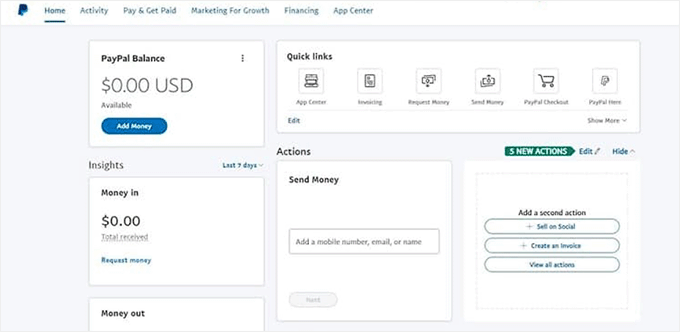

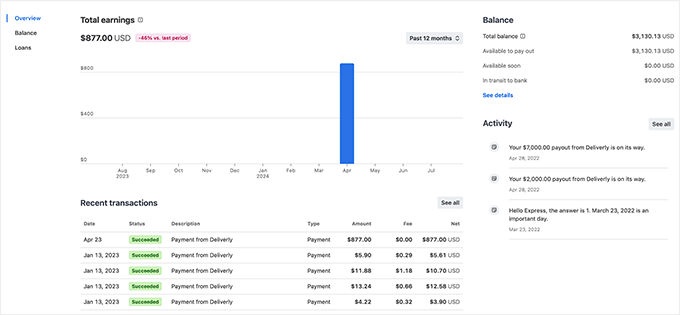

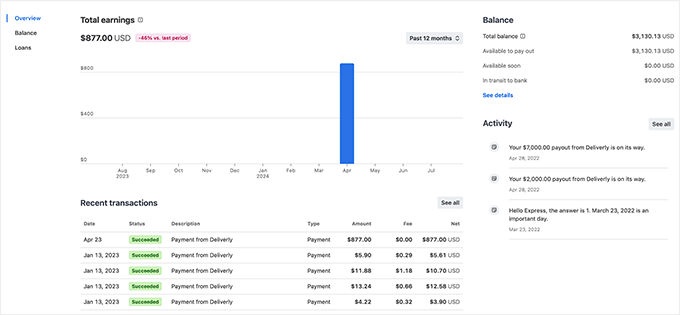

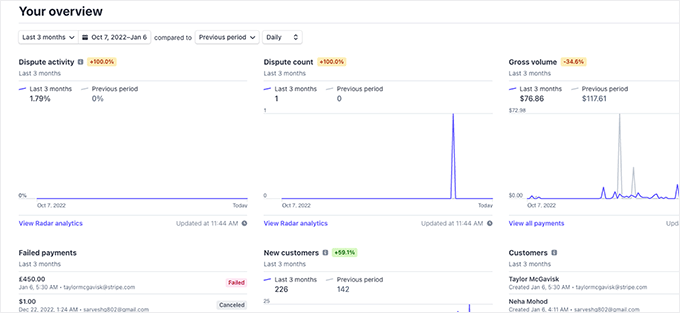

The Stripe dashboard is designed to give you complete control over your payments while keeping things simple and user-friendly.

When you log in, you will notice a clean, modern interface that provides an overview of your recent transactions, revenue, and payment trends.

The dashboard’s navigation is intuitive, so you can easily find what you need, whether it’s processing refunds or managing customer subscriptions.

It also has detailed reporting tools. You can view in-depth analytics on your sales performance, track customer payment behaviors, and even monitor payouts to your bank account.

For subscription-based businesses, the Stripe dashboard allows you to manage plans, set pricing tiers, and view metrics like churn rate and recurring revenue.

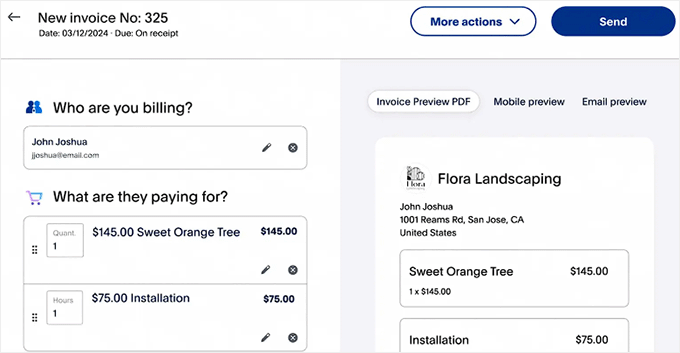

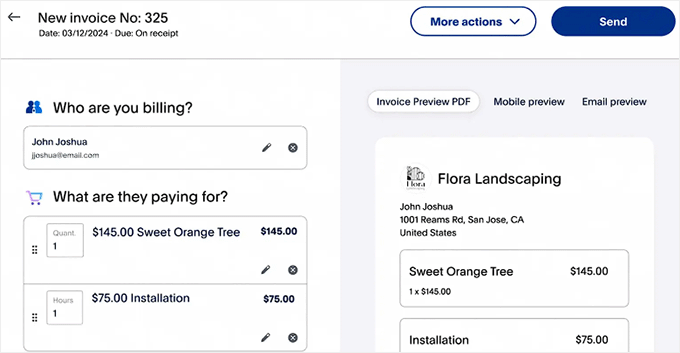

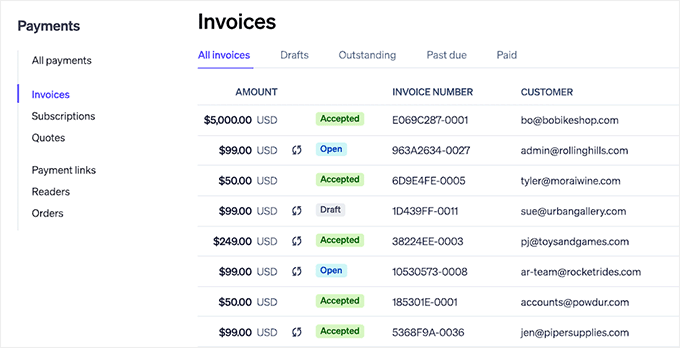

You can set up automated email receipts, manage saved customer payment methods, and create custom invoices directly from the dashboard.

We also love its built-in tools for detecting and preventing fraud, which add an extra layer of security for your business.

Whether you are new to managing online payments or a seasoned business owner, Stripe gives you all the essentials, as well as advanced tools that anyone can use.

Winner – Tie

When it comes to ease of use, both PayPal and Stripe shine in their own ways, so we’ve decided that this category is a tie.

PayPal has a straightforward dashboard design, which makes it super beginner-friendly. You can easily navigate through basic features like viewing transactions, sending invoices, and issuing refunds without feeling overwhelmed.

On the other hand, Stripe caters to users who are willing to explore its powerful features. While its dashboard may seem more complex due to its advanced tools, Stripe makes up for it with detailed tutorials, guides, and FAQs.

Transaction Fees

Transaction fees can be the most confusing part when choosing a payment processor. In the next section, we’ll help clarify them for both Stripe and PayPal.

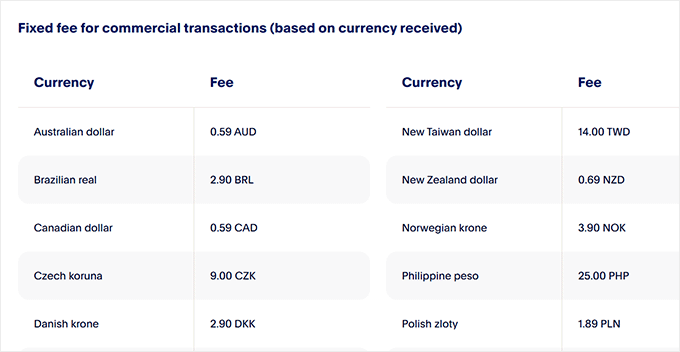

Transaction Fees – PayPal

While comparing transaction fees, we noticed that PayPal is a bit on the pricey side.

What’s more, the platform’s fees vary depending on several factors, which means the cost of using PayPal isn’t always straightforward.

For starters, the standard domestic transaction fee in the United States is 2.9% + $0.30 per transaction. It is the same for merchants and individuals.

But this amount can increase if you are dealing with international payments or currency conversions.

If you are selling to customers in other countries, then PayPal charges an additional fee of around 1.5% on top of the standard transaction rate.

Plus, if there’s any currency conversion involved, PayPal adds a hefty conversion fee, which can range from 2.5% to 4%.

These extra charges can really add up, especially for businesses that deal with international customers.

Here is a clear breakdown of PayPal’s transaction fees to help you see exactly what you’ll pay:

Standard domestic transaction fee (U.S.): 2.9% + $0.30 per transaction (for merchants and individuals)

International payments: Additional 1.5% fee

Currency conversions: Additional 2.5% to 4% fee

Now that you know all of PayPal’s transaction fees, let’s see how Stripe compares.

Transaction Fees – Stripe

Stripe offers the same rate as PayPal for online card payments at 2.9% + $0.30 per transaction. This is the cost for merchants as well as the personal transaction fee.

However, many businesses find Stripe more cost-effective because of its lower fees for currency conversions and additional payment methods.

Unlike PayPal, which adds hefty costs for international transactions, currency conversion, or even refunds, Stripe has lower fees.

Plus, it doesn’t charge setup fees, monthly fees, or additional fees on refunds, so you only pay when you process a payment.

This is a huge advantage for businesses that want to expand globally. 🌎

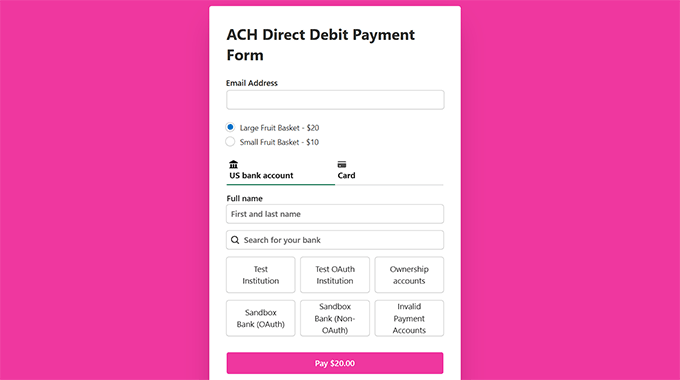

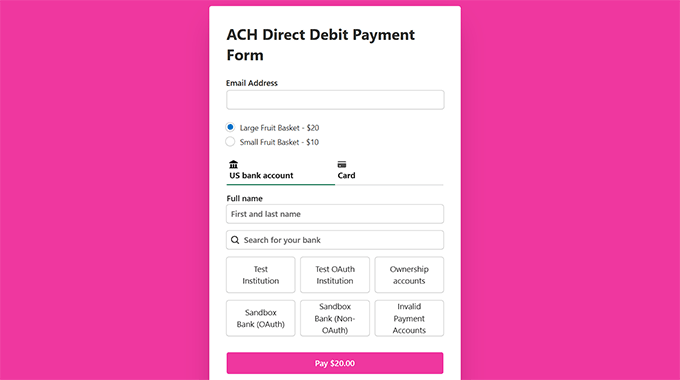

On top of that, it supports ACH Direct Debit with a fee of just 0.8%, capped at $5, which is perfect for larger transactions and high-ticket items.

That said, here’s a clearer cost breakdown for Stripe’s fees:

Online card payments: 2.9% + $0.30 per transaction (for merchants and individuals)

International transaction fee: 1.5%

Currency conversions: 1%

ACH Direct Debit: 0.8% fee (capped at $5)

Winner – Stripe

Stripe is the clear winner for transaction fees. It offers a simple fee of 2.9% + $0.30 per transaction. On the surface, these fees look the same as PayPal’s.

But it charges less for currency conversions and doesn’t charge for refunds, which makes it significantly cheaper than PayPal.

Invoice & Billing Fees

The way each payment processor handles invoicing, recurring payments, and associated costs can impact your overall expenses. Here’s our assessment of Stripe vs. PayPal in this important category:

Invoice & Billing Fees – PayPal

PayPal makes it easy to send invoices, but there are fees to keep in mind. Creating and sending an invoice is free, but once it is paid, PayPal treats it as a commercial transaction.

For regular online payments through your store, the platform charges 2.9% + $0.30 per transaction in the U.S. However, for invoices, the fee is higher at 3.49% + $0.49 per transaction.

While sending the invoice doesn’t cost anything, you will pay this higher merchant fee when the payment comes through.

If you are dealing with international clients, additional fees for cross-border transactions and currency conversions can make invoicing even more expensive.

That said, one upside is that PayPayl’s invoicing tool is super easy to use.

You can create professional invoices, set due dates, and even allow partial payments, all from the dashboard.

Still, for businesses that send a high volume of invoices, the transaction fees can add up quickly, making PayPal a pricey option for billing.

So, to summarize it, here are PayPal’s invoicing fees:

Creating invoices: Free

Sending invoices: 3.49% + $0.49 per transaction

Additional fees for cross-border transactions and currency conversions

Invoice & Billing Fees – Stripe

Stripe Invoicing provides flexible options with two plans: Starter and Plus.

The Starter plan includes 25 free invoices each month, with a 0.4% fee for every paid invoice after that.

On the other hand, the Plus plan comes with more advanced features and charges 0.5% per paid invoice. This makes it a great choice if you want more control over your billing process.

For businesses managing recurring charges, Stripe Billing is a fantastic feature. Its standard plan offers a 0.5% fee per recurring charge, with a Scale plan available at 0.8%.

The Scale option integrates with tools like NetSuite and provides customers with upfront quotes before subscriptions begin. For high-volume businesses, Stripe also offers custom pricing, which can help reduce costs further.

Whether you need simple invoicing or advanced subscription management, Stripe’s pricing structure and custom pricing make it a great option for efficient billing.

In short, Stripe charges:

Starter plan: 25 free invoices/month, 0.4% fee per paid invoice afterward

Plus plan: 0.5% fee per paid invoice

Recurring charges: 0.5% fee (Scale plan: 0.8%)

Custom pricing for high-volume businesses

Winner – Stripe

After careful evaluation, we believe that Stripe is clearly the better option when it comes to billing and invoicing fees.

With its Starter plan offering 25 free invoices per month and a low 0.4% fee for each paid invoice afterward, it’s more budget-friendly than PayPal, which charges a percentage of the payment plus a fixed fee per transaction.

Global Reach and Supported Currencies

A payment processor’s global reach and support for multiple currencies can make a huge difference in your store’s success. Let’s see how PayPal and Stripe compare when it comes to worldwide availability.

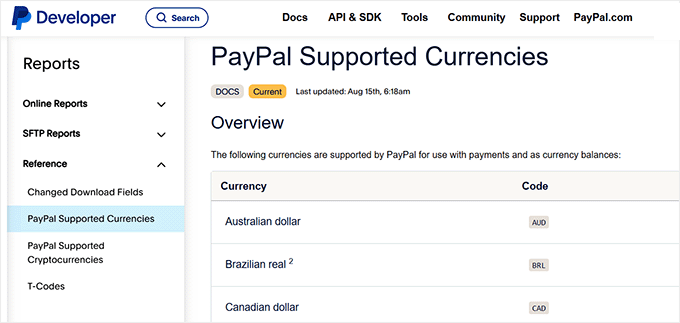

Global Reach and Supported Currencies – PayPal

PayPal has impressive global coverage, making it a popular choice for businesses that want to reach customers worldwide.

It is available in over 200 countries and supports 25 currencies, making it easy to send and receive payments across borders.

Plus, we think that one of PayPal’s biggest advantages is its familiarity. Millions of people already trust and use PayPal, which can make customers more comfortable completing transactions.

However, while PayPal supports many countries, its currency options are limited compared to some competitors. If your business operates in a region with less common currencies, you might face restrictions or need to rely on currency conversions, which can add extra fees.

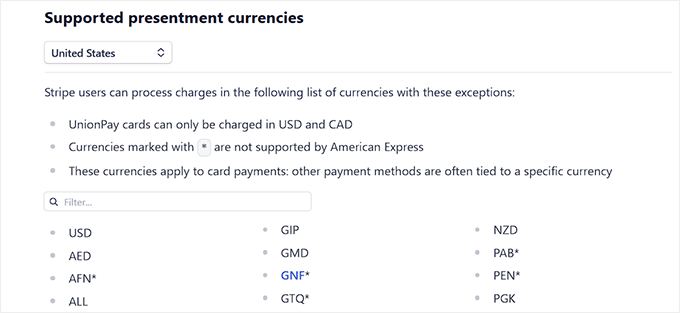

Global Reach and Supported Currencies – Stripe

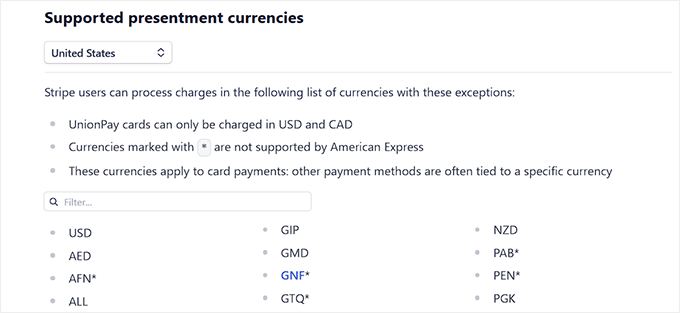

Stripe is another excellent option for businesses with a global audience. It’s available in over 46 countries and supports payments in more than 135 currencies.

This wide currency support makes it easier for businesses to accept payments from customers around the world in their local currencies, providing a smoother checkout experience.

What’s great about Stripe is how it automatically handles currency conversion. If you sell globally, this can save you time and effort while keeping things simple for your customers.

Stripe also allows you to display prices in local currencies, which can build trust and make customers more likely to complete their purchases.

For businesses in supported countries, Stripe’s extensive currency options and seamless international payment tools make it a fantastic choice for selling to a global audience.

Winner – Tie

In this category, we’ve decided it’s a tie between PayPal and Stripe.

This is because PayPal takes the lead in availability, operating in over 200 countries, but it only supports 25 currencies, limiting flexibility for businesses.

On the other hand, Stripe supports over 135 currencies, giving businesses the ability to accept payments in nearly any local currency. However, it is only available in 40+ countries, so its reach is more limited compared to PayPal.

Ultimately, the best option depends on your business needs. If you are prioritizing widespread availability, PayPal is the better choice. But if handling diverse currencies is more important to you, then Stripe has the edge.

Accepted Payment Options

Offering a variety of payment options is important for meeting customer expectations and boosting conversions. Here’s how Stripe and PayPal compare in this category:

Accepted Payment Options – PayPal

PayPal offers a solid range of payment options that make it a trusted choice for businesses.

Customers can pay using PayPal balances, credit and debit cards, and even linked bank accounts. It also supports popular digital wallets like PayPal Credit and Venmo (in the U.S.), which adds flexibility for customers.

However, PayPal doesn’t go as far as Stripe in terms of variety. For example, it doesn’t support some alternative payment methods like Google Pay or Apple Pay in all regions.

This can be a drawback if your business operates where these payment methods are popular.

Accepted Payment Options – Stripe

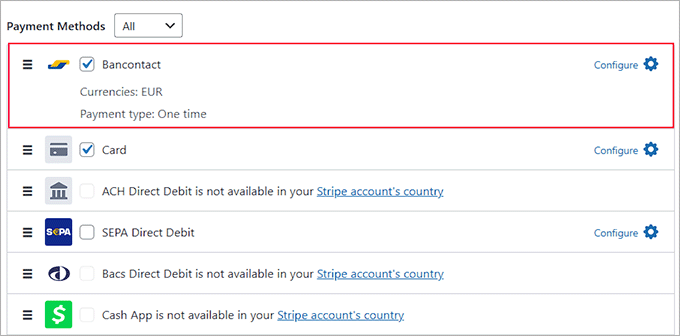

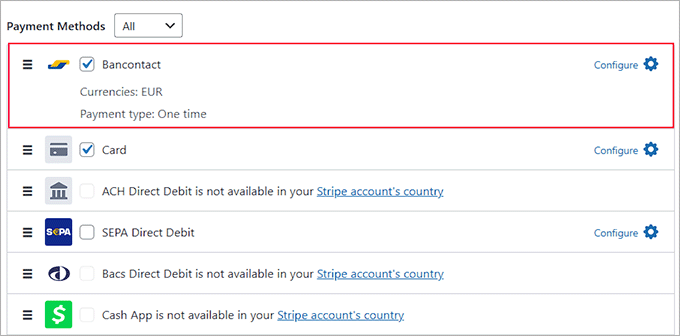

Stripe stands out when it comes to offering a wide variety of payment options. In addition to accepting all major credit and debit cards, Stripe supports digital wallets like Apple Pay, Google Pay, and Microsoft Pay.

It also integrates with popular international payment methods, including Alipay, Cash App, Bancontact, and Klarna, making it ideal for businesses that sell globally.

One of Stripe’s most impressive features is its ability to handle bank-based payment options like ACH transfers, SEPA Direct Debit, and even buy now, pay later (BNPL) services.

This level of flexibility allows your business to cater to a diverse audience, whether you prefer traditional payment methods or popular regional options.

Winner – Stripe

Stripe is the obvious winner for payment options.

While PayPal offers the basics like credit cards, PayPal Credit, and Venmo, Stripe goes above and beyond with support for Apple Pay, Google Pay, ACH transfers, BNPL, and even international options like Alipay and Klarna.

Integration With WordPress

If you are deciding between Stripe and PayPal for your WordPress site, then seamless integration between your payment processor and website is a must.

In this next section, we’ll talk about how PayPal and Stripe compare when it comes to integrating with WordPress.

Integration With WordPress – PayPal

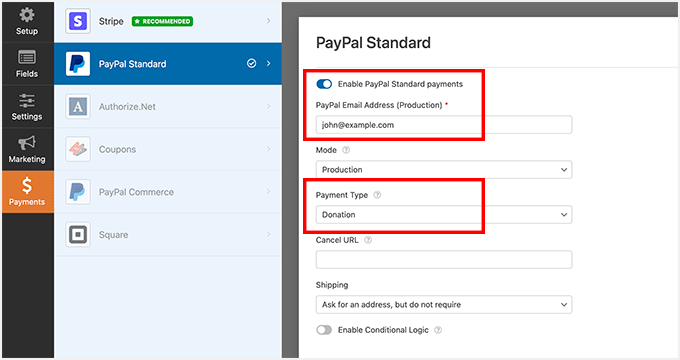

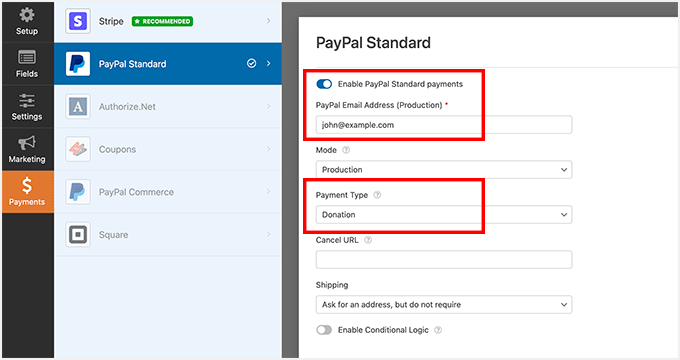

PayPal integrates easily with WordPress, thanks to its compatibility with popular plugins like WPForms, Easy Digital Downloads, and WooCommerce.

Many of these plugins come with built-in PayPal support, allowing you to set up payment options quickly without any extra hassle.

For example, WPForms lets you add PayPal as a payment option for donation or order forms, while WooCommerce allows you to accept PayPal payments during checkout.

We’ve used PayPal on our WordPress sites to accept payments, and the integration process has always been smooth.

Its ease of use makes it a convenient choice for WordPress users who want a simple, reliable payment solution. For details, see our tutorial on how to add PayPal payment forms in WordPress.

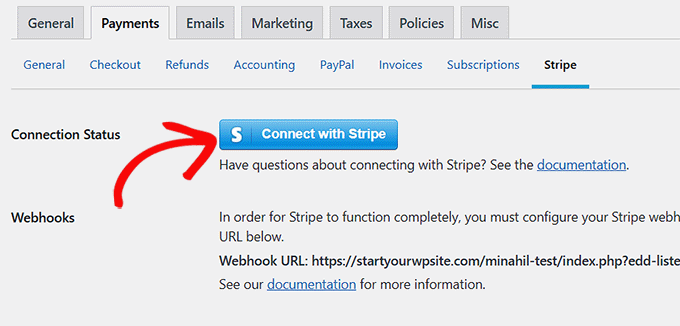

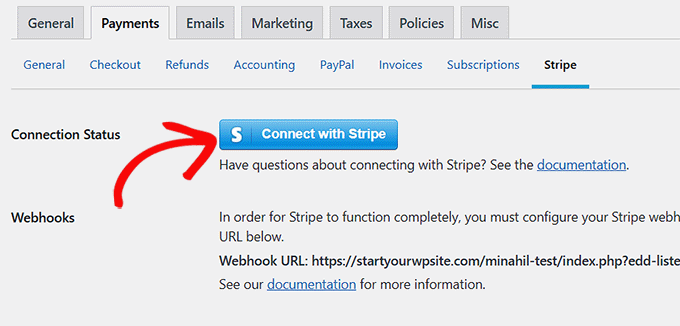

Integration With WordPress – Stripe

Stripe also integrates seamlessly with WordPress, which is a huge plus.

It comes with built-in integration for WPForms, Easy Digital Downloads (EDD), and WooCommerce, so you can accept payments effortlessly.

We use EDD on several of our WordPress sites and have integrated it with Stripe. The process was quick, hassle-free, and works perfectly for selling digital products.

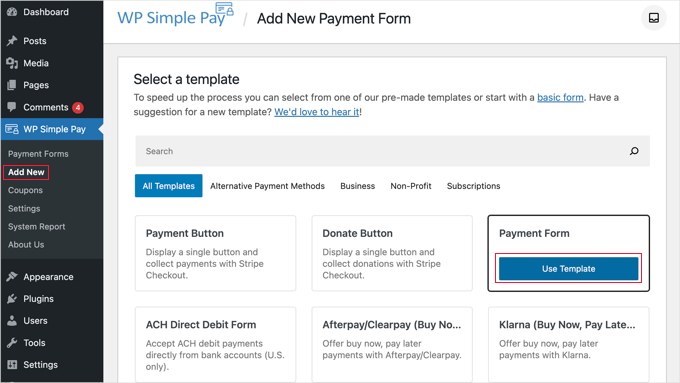

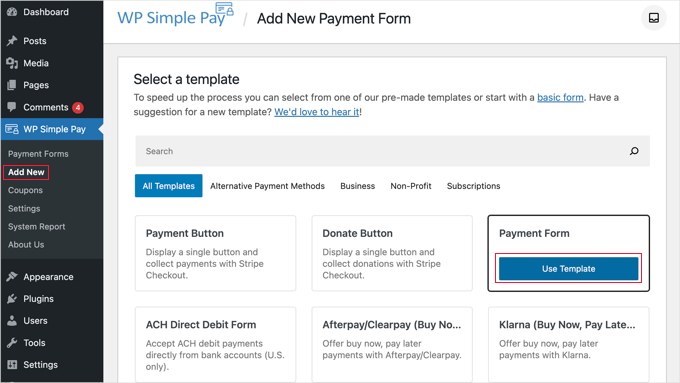

We also recommend checking out WP Simple Pay if you want to accept Stripe payments using WordPress payment forms.

This powerful Stripe plugin helps you quickly create payment forms and gives you access to a variety of payment options, including Klarna, Alipay, and SEPA Direct Debit.

This makes it an excellent choice for businesses that want to offer more payment methods without extra plugins or coding.

Whether you are running a small online store or a subscription service, Stripe’s compatibility with WordPress plugins ensures easy integration and a smooth payment experience.

For details, see our guide on how to accept Stripe payments in WordPress.

Winner – Tie

PayPal and Stripe offer seamless integration with WordPress and its plugins.

For example, popular WordPress eCommerce solutions like WooCommerce, WPForms, and Easy Digital Downloads all support PayPal and Stripe, allowing you to add these payment processors to your WordPress site with minimal setup.

Security

When it comes to handling payments online, security is a top priority. You’ll need to protect your customers’ sensitive information throughout the transaction process.

Now, let’s explore PayPal vs. Stripe in terms of security features.

Security – PayPal

PayPal is known for its strong security features, which make it a trusted payment processor for many businesses. It uses advanced encryption technologies, including SSL, to protect sensitive customer data during transactions.

Additionally, it offers fraud protection tools, such as 24/7 monitoring, to detect and prevent unauthorized transactions.

PayPal’s Seller Protection is also pretty impressive. It helps cover eligible transactions in case of disputes or chargebacks. This can give you peace of mind, especially when dealing with international customers or high-value transactions.

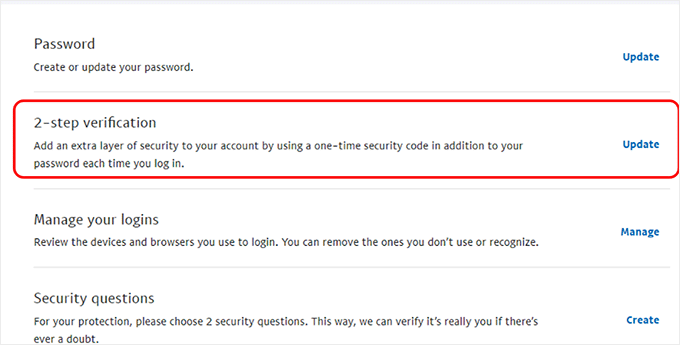

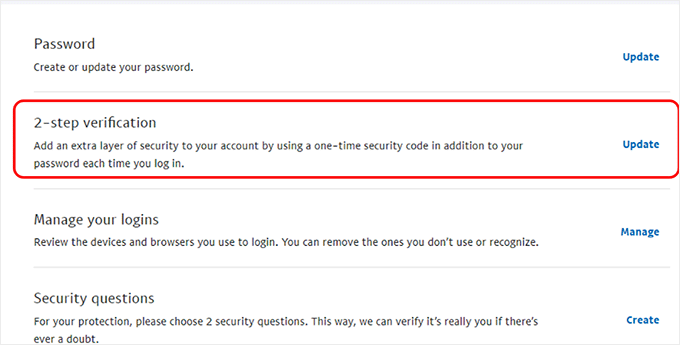

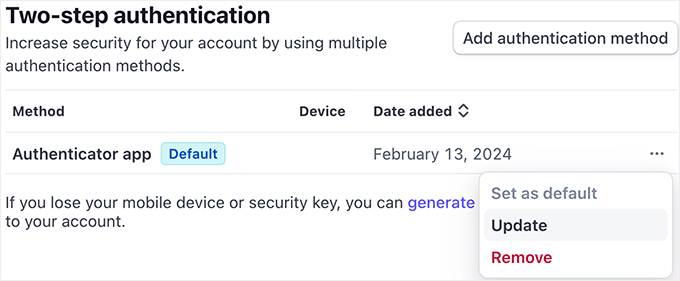

PayPal also supports two-factor authentication (2FA) for added account security.

Overall, PayPal’s security measures are reliable, making it a solid choice for businesses looking to protect both themselves and their customers.

Security – Stripe

On the other hand, Stripe also offers top-notch security features, ensuring both merchants and customers are well protected.

It uses advanced encryption protocols and complies with the highest security standards, including PCI-DSS Level 1. This means that sensitive customer information, like credit card details, is securely handled at all times.

We also really like Stripe’s built-in machine learning tools (aka computer programs), which can spot and stop fake payments in real time.

It also offers advanced features like tokenization. We know this sounds fancy (and it is).

But it also just means it replaces sensitive card details with secure ‘tokens’, so customer data is never saved on your servers.

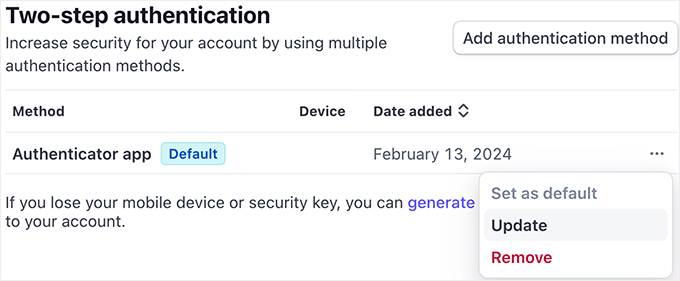

Additionally, it comes with two-factor authentication (2FA) and regular security updates to keep your account safe from potential threats.

All in all, Stripe provides a secure environment that helps protect both businesses and customers from fraud and data breaches.

Winner – Tie

Both Stripe and PayPal are highly secure payment options, giving businesses and their customers peace of mind. They follow strict industry standards like PCI-DSS compliance to protect sensitive payment information.

Each platform has unique features. PayPal offers built-in buyer and seller protections, which are great for resolving disputes. Meanwhile, Stripe excels with its AI-powered fraud detection system, Stripe Radar, which stops suspicious activity.

No matter which platform you choose, both Stripe and PayPal prioritize security at every step, making them trusted solutions for businesses of all sizes.

Stripe vs. PayPal: Which Is Better for Your WordPress Site?

In our opinion, Stripe is the better payment option for your WordPress site. It offers lower transaction fees, supports a wider variety of payment options, and integrates seamlessly with plugins like WP Simple Pay to add payment methods such as Klarna and SEPA.

Plus, Stripe’s powerful security features and detailed analytics make it a favorite for businesses looking for scalability and customization.

That said, PayPal is still a solid option. It is a great choice if your audience prefers using PayPal accounts for payments, especially since it’s widely recognized and trusted globally.

It’s also an ideal fit for businesses that rely on PayPal’s built-in invoicing tools or frequently handle dispute resolution.

Ultimately, Stripe is ideal for businesses looking for flexibility, lower fees, and advanced features, while PayPal shines for its simplicity and global familiarity.

Plus, you don’t have to just choose one or the other. Many online stores offer both Stripe and PayPal payments, which is worth considering. Offering more payment methods can help you appeal to more customers and increase your sales.

💡 Expert Tip: Running a global online store? A fast, optimized site is key to keeping customers happy and boosting sales. Our Site Speed Optimization Services can help improve your store’s performance for shoppers around the world. To learn more, see our WPBeginner Pro Services page.

Frequently Asked Questions About Stripe vs. PayPal

Here are some questions that are frequently asked by our readers about Stripe and PayPal.

Can I use both Stripe and PayPal on my WordPress site?

Yes, many businesses use both Stripe and PayPal on their WordPress sites to provide customers with more payment options.

Both payment processors integrate seamlessly with popular eCommerce plugins, ensuring secure and convenient transactions.

Offering multiple payment methods can also help reduce cart abandonment rates. If customers can’t pay using their preferred method, they may leave without completing their purchase.

By providing both Stripe and PayPal, you eliminate that friction and improve conversion rates.

That is why we use both Stripe and PayPal across several of our partner brands, including All in One SEO and MonsterInsights.

Between Stripe and PayPal, which one supports more payment options?

Stripe supports a wider range of payment options, including credit cards, ACH payments, Apple Pay, Google Pay, and even digital wallets like Alipay.

PayPal primarily supports payments through PayPal accounts and credit cards, but Stripe offers more flexibility, especially for global transactions.

Is PayPal better for international payments?

While PayPal is available in over 200 countries and supports 25+ currencies, Stripe operates in 45+ countries and supports over 135 currencies.

Stripe may be the better choice for businesses with a large international customer base because of its competitive transaction fees and global support for different currencies.

Is Stripe or PayPal safer for handling payments?

Both payment processors are very secure, offering top-notch protection against fraud.

PayPal has powerful buyer and seller protections, while Stripe uses AI-powered fraud detection and tokenization to ensure secure transactions.

Either option provides strong security for your WordPress site, so you don’t need to worry about customer data breaches.

We hope this article helped you decide whether Stripe or PayPal is the better choice for your WordPress site. You may also want to see our beginner’s guide on how to accept deposit payments in WordPress and our list of important online payment statistics, data, and trends.

If you liked this article, then please subscribe to our YouTube Channel for WordPress video tutorials. You can also find us on Twitter and Facebook.